Lots of people take loans from online loan apps (or fintech apps who mostly offer lending services) however there are several major banks who also provide loans without collateral to their customers.

These banks provide these loans mostly through their mobile apps or website.

This article will detail how you can secure small loans online from some of the traditional banks you know.

We profile only traditional banks that offer loans without collateral, through their online channels without need for paper work.

GTBank

GTBank has one of the most seamless online loan offerings through its GTWorld or GTBank apps. Customers of the bank can log into their bank apps, check the loans segment to see if they qualify for any of the online loans the bank offers.

GTBank offers two major loans online namely;

Quick Credit – Quick Credit offers loans to workers or people gainfully employed with steady income. Quick Credit, according to information on the GTBank website, can give you up to N5 million loan (or equivalent of 3 times multiples of your monthly salary) with a repayment period of up to 12 months. Repayment is with an interest rate of 1.5%, one of the lowest available in the country. You can access Quick Credit through your GTBank/GTWorld app or by dialling *737*51*51#. More about Quick Credit here

Salary Advance – Salary Advance is another online loan from GTBank. It gives 50% of your monthly salary with a repayment period of 30 days. It is available to staff of private companies, government agencies with active salary accounts domiciled in GTBank. Once you repay you can renew the loan monthly. A customer has to have/earn minimum N25,000 (for public sector employees) or N50,000 (private sector employees). A customer can apply for this loan via their bank app, through internet banking or via the USSD code – *737*51*51#

Access Bank – Payday Loan

Access Bank has the payday loan which is an instant loan for customers who are mostly salary earners. As usual with online loans profiled in this article you do not need collateral or to visit the physical offices of the bank to apply and get the loan.

Repayment is within 31 days. The amount you can qualify to take depends on how much you earn as salary and based on the activity on your account with the bank.

Customers can apply for the loan via the bank’s internet banking website, through the Access Bank app, or by dialling *901*11*1#

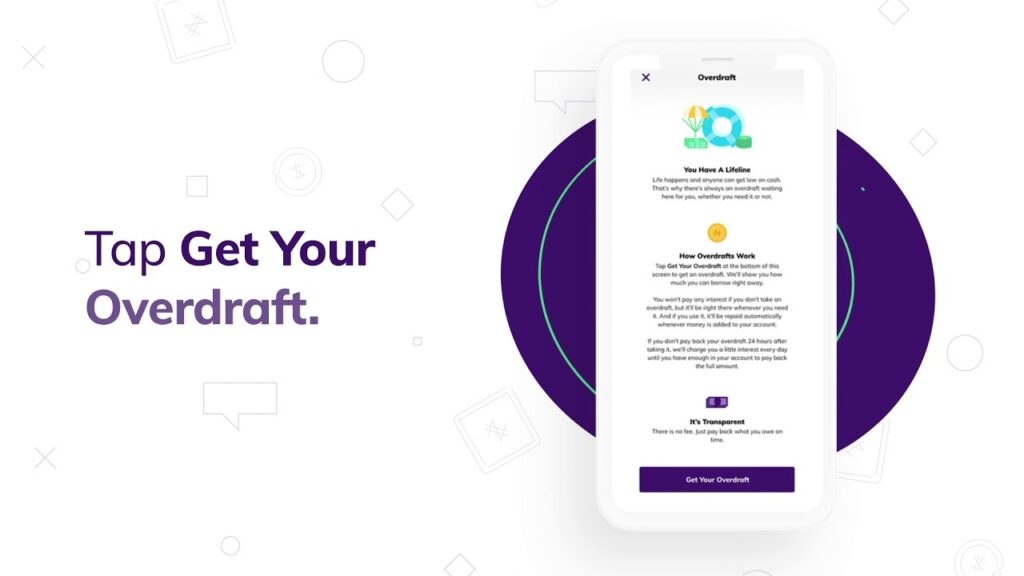

Kuda Bank – OverDraft

Kuda is a microfinance bank with a digital only approach to banking. You can create a bank account, verify your identity and carry out most banking transactions (including transfers, bill payments, etc) all on the app.

Kuda offers a short term online loan you can take from the app when you have used your account actively for a period of time. The Kuda overdraft has a relatively high interest rate of 0.3% with the key advantage being the flexibility of having a daily interest so the borrower can pay less interest if he/she pays off earlier.

Users can borrow from within the app by going to tap on the Borrow tab.

Stanbic IBTC

Stanbic bank offers a couple of instant online loans for individuals and small businesses.

Personal Loans – Stanbic offers unsecured instant personal loans for individuals to meet their personal needs. You need to have minimum N20,000 monthly to qualify for the loans with a flexible repayment. You can apply online and when approved you get the funds directly to your account.

To qualify applicant must have worked with an employer for at least six months with your salary account domiciled in Stanbic bank. You must be at least 21 years old and a Nigerian citizen.

EZ Cash for SMEs – EZ Cash for SMEs is an instant loan for small businesses that qualify for certain eligibility criteria. Small businesses can apply for up to N5 million at a 2.5% monthly interest and a repayment period of up to 6 – 12 months.

You can request for the EZ Cash for SME loan through the Stanbic IBTC online and mobile banking platforms or through *909*44#. You can check here for more details on the Stanbic IBTC EZ Cash for SME Loan

Wema – ALAT Salary Based Loan

Wema Bank offers salary based loans online through its ALAT banking app. Salary earners can get from N50,000 to N4 million in loans with 2% monthly interest rate.

The process is entirely online. The customer can apply for the loans via the ALAT app and get a decision on whether they qualify for the loan or not within a few hours.

UBA Click Credit

United Bank for Africa (UBA) has an online loan product called Click Credit (sounds like a mimic of the GTB Quick Credit eh?). The bank describes it as a super fast open to anyone with a UBA account.

Borrowers can borrow up to N1 million dependent on their monthly salary with repayment period of up to 12 months. You can access the UBA click credit loan online (via the website or app) or through the USSD code – *919#. Interest is 2.5% monthly or 30% annually.

Sterling Bank (Specta)

Sterling bank has a lending platform called Specta where individuals and businesses can get up to N5 million loan in minutes without collateral or paperwork.

Interest rate on loans are between 25.5% – 28.5% per annum. There is one off insurance fee of 2.5%, management fees of 1%, and a repayment period of between 1 – 12 months.

ALSO SEE

![Top Refer and Earn Apps in Nigeria to Help You Make Money on the Side [Full List] refer and earn apps](https://nairabrains.com/wp-content/uploads/2022/04/refer-and-earn-apps-1-1024x576.png)

![Binance Statistics 2022: Top Countries That Use Binance Most [+ Other Key Stats] ways to make money with cryptocurrency](https://nairabrains.com/wp-content/uploads/2022/04/ways-to-make-money-with-cryptocurrency-1.jpeg)