Kuda bank is one of the fastest growing digital banks in the country (with its 100% digital banking solution provided through the Kuda bank app).

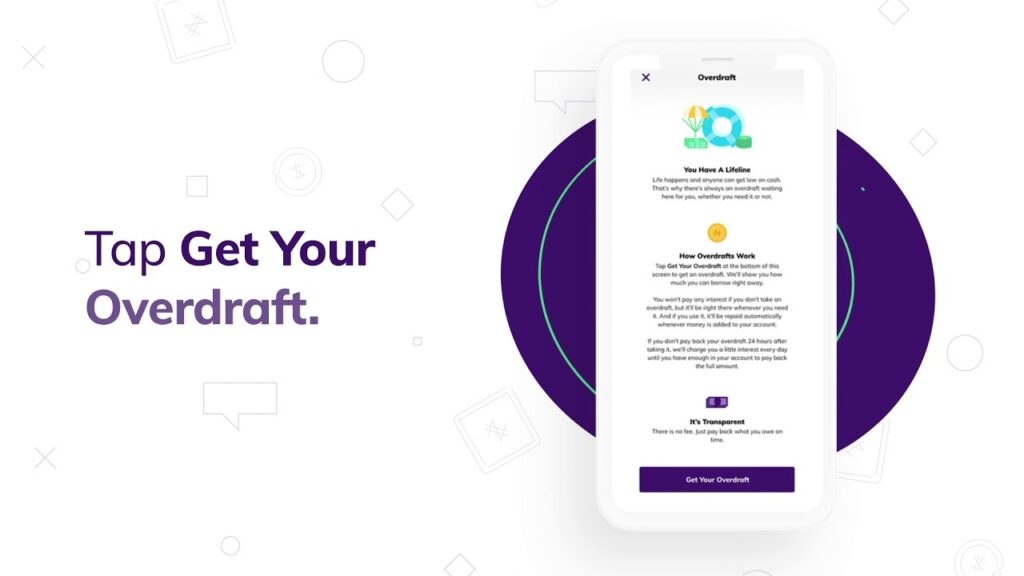

Not many people know that Kuda bank has an online loan facility for its customers. Usually known as Kuda bank overdraft, the bank says it is a short term loan advanced to customers who have operated an account for sometime and qualify for the loan.

If you have some interest in Kuda bank overdraft we hope this article breaks it down as much as possible.

Information about Kuda Bank Overdraft

On its website Kuda bank describes the Kuda Overdraft as short term loans you can take anytime as long as you use your account regularly.

However we found out that as a Kuda bank customer you may not immediately be eligible to take the overdraft until you’ve operated your bank account for several months as well as done a decent volume of transactions through it.

There is nowhere they state how much or the volume of transactions (deposits for eg) that you need to have done via the bank app to qualify for the kuda bank overdraft. We estimate that for a user to be eligible he/she must have done at least hundreds of thousands of Naira in transactions (especially deposits).

We also think it helps if you use your kuda bank to receive periodic, regular payments like salaries, interests on investments etc.

After some months of using your kuda bank regularly you can then try to apply for the kuda bank overdraft.

Key details of Kuda bank overdraft

- Kuda bank is usually a short term loan (30 days) you can use to bridge the gap for a few weeks till you get paid your work salary or for a job done for which you’re expecting payment

- For.a kudabank overdraft you are charged 0.3% daily interest. This amounts to 9% monthly interest which appears high compared to other bank online loans such as GTBank Quick Credit

- When you apply for the loan/overdraft Kuda will evaluate and show you an amount you are eligible to access.

- You have within 3 business days to reject the loan/overdraft offered you. This does not attract any charges.

How to Apply for Kuda bank overdraft

To apply for Kuda bank overdraft you need to have been a customer of the bank for some months already, using the kuda bank app for deposits and other transactions regularly.

If you fulfill the above requirements you can

- log into your Kuda bank app,

- tap on BORROW

- tap – Get Your Overdraft

- tap Next

- Type in the amount you intend to borrow then tap Done

- Confirm with your transaction PIN, finger print or Face ID

- Tap OK and the amount will reflect in your account balance for you to spend

ALSO SEE