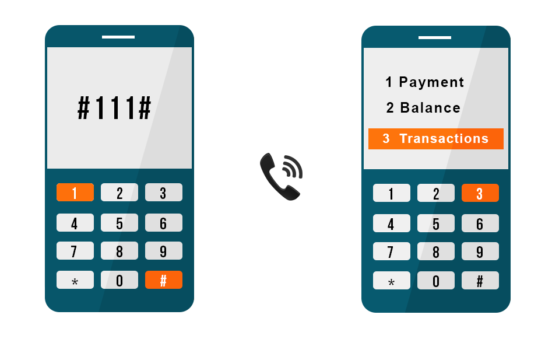

Bank USSD Codes for money transfer is one innovation that has revolutionised banking business and services in Nigeria. The advent of the Global System Mobile Communications (GSM) ushered in the adoption of the Unstructured Supplementary Service Data (USSD). This service ‘session’ has been adopted by financial institutions so that customers using feature phones can easily embark on financial transactions. And this is a major advantage of using the USSD service.

Although there were no charges for using this service previously, the federal government of Nigeria recently introduced a service fee of ₦6.98 for Nigerians using the platform. Nevertheless, Nigerians are still using the platform when need be because sometimes, it is easier and faster. Meanwhile, it must be noted that there is a cap limit to the amount of transfers a customer can make while using USSD. However, the limit varies across the various banks.

Interestingly, using the USSD platform comes with its perks. Just like online banking, you can buy data, recharge cards, pay bills and embark on various financial transactions from the comfort of wherever you might be without stressing yourself. It must be noted that USSD transfers tend to come with service charges and they vary from bank to bank.

Also, you incur charges when you transfer money to an account within your bank and likewise outside your bank. And you can only use the phone number which you used in registering your account with the bank. Although a piece had been written before on the various USSD codes used by various banks in Nigeria, this article is set to update it.

Access Bank

For users of Access Bank, dial *901*Amount*Account Number. For instance, *901*25000*0816286947# from the registered phone number attached to your account. Then ensure your authenticate the transfer by inputing the last 4 numbers of your BVN which you alone must know.

If you want to transfer money to other accounts in different banks, dial *901*2*Amount*Account Number#. This transactions incurs a service fee of ₦80 only.

Ecobank

From your registered number, enter *326#, further dial the account number of the receiving account and then choose the bank of the recipient. Ensure you confirm that the details of the receiver tallies with what you have then when you are sure, authenticate the transaction by putting your 4 digit secret pin.

Fidelity Bank

Simply dial *770*Account Number*Amount#. Identify the bank which the money is going to and input your secret pin. Service charge for both inter an intra bank is ₦50.

First Bank

Just dial *894*Amount*Account Number#, pick the bank, confirm the amount you are sending and the name of the recipient then input your 4 secret pin, thereafter, you identify the account to be debited. The amount charged for transferring to other banks is ₦52.

First City Monument Bank (FCMB)

From the number you used in registering at the bank and which is linked to your account, dial *329*Amount*Account Number#.

Guaranty Trust Bank (GTB)

To transfer with your GTB USSD, dial *737# from the registered number attached to your account and follow the prompt carefully. There is a service fee, which the bank charges. ₦20 for intra bank transaction ₦25 for interbank transactions.

Heritage Bank

Dial *322*030*Account Number* Amount. Then identify the bank the money is being transferred to and the name of the account holder and type either the last 4 numbers at the back of your MasterCard or the 4 digit pin you created for USSD transactions.

Polaris Bank

To transfer money from your Polaris account to another account, type *833*Amount*Account Number# and simply follow the instructions. However service charges vary, while intrabank transfers cost ₦20 interbank cost ₦52.

Stanbic IBTC

To transfer within the bank, simply dial *909*11*Amount*Account Number#. But if it’s to another bank dial *909*22*Amount*Account Number#. Although the bank does not charge for intra bank transactions, it charges ₦52.50 for interbank transactions.

Sterling Bank

For users of this bank, you can transfer between ₦100,000 and ₦500,000. However, ₦500,000 is the maximum. To use this service on your phone and transfer to another Sterling Bank account dial *822*4*Amount*Account Number# follow the prompts and make your transaction. If you are sending the money to another account dial *822# pick the menu option that says transfer to other banks and carry out your transaction.

United Bank for Africa (UBA)

Regardless of the account you are sending money to be it a UBA account or another bank, UBA charges ₦70 as service fee. To use the USSD platform on your phone, dial *919*3*Account Number*Amount#. If you ae sure of the name and the account that pops up enter your four digit pin and make the transaction.

Union Bank of Nigeria

Simply dial *826*1*Amount*Account Number# and then follow the prompt to send money to a Union Bank account. But if you are sending to another bank simply dial *826*2*Amount*Account Number# and then follow the prompt. Perhaps you want to increase the limit of your financial transactions dial *826*8# and follow the prompt. For interbank services the bank charges ₦52.50, while sending money to Union Bank accounts are free.

Wema Bank

To use Wema bank’s USSD, dial *945# and follow the prompt religiously. However a service fee of ₦21 is charged for transfers within the bank and ₦52 to accounts outside the bank is charged for using USSD. Although the daily limit for USSD transfer is ₦20,000 it can be increased by visiting the bank for USSD transfer increment.

Zenith Bank

To transfer money to another person, regardless of bank, simply dial *966# and follow the prompt. Although there are no charges for intrabank transactions, there are charges for interbank transactions.

USSD codes for money transfer has come to become a mainstay in retail banking in Nigeria and it is one of the easiest means of embarking on financial transactions. People with smart phones opt to use USSD when they either have poor internet network or have no internet data to use internet banking. Financial institutions upon realizing that people are using USSD more are improving the services USSD will provide so that people will be comfortable using the platform for their financial transaction.